Profitability

Need for balance and meaningful action amid huge wins

Another year of robust profits for general insurance – the strongest in more than 10 years – will likely intensify focus on pricing practices and fairness. While a long-term lens is vital for perspective, the industry has a timely opportunity to reflect and invest purposefully in better customer experience.

The general insurance industry recorded its strongest result in more than 10 years with a profit after tax of $7.3 billion over the 12 months to 30 June 2025. This builds on the strong performance in 2024, with the industry recording profit after tax of $3.9 billion in the nine months to 30 June 2024.1

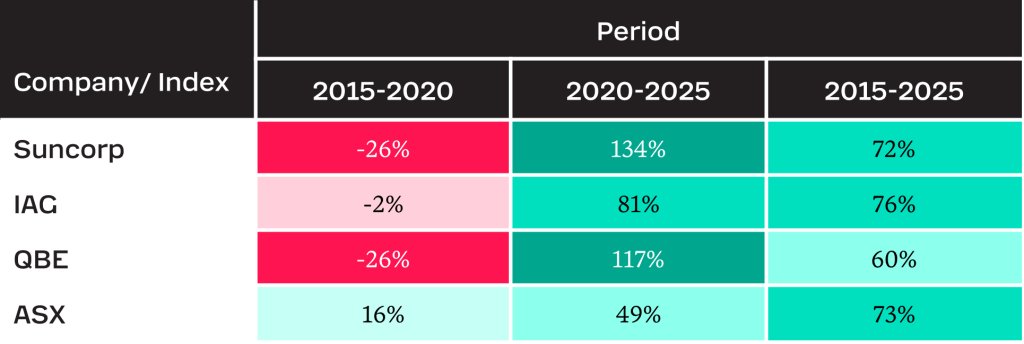

This strong performance is reflected in recent share prices, where from September 2020 – the middle of COVID-19 – to now, Suncorp, IAG and QBE’s share prices have increased at twice the rate of the broader market. (~100% vs 50%).

Understandably, consumers may question the big result in a time of ongoing cost-of-living and insurance affordability pressures, and it will likely increase focus on pricing practices and fairness. But it’s important not to view profits solely from a one-year window. Insurance is a naturally volatile business year on year, protecting people in times of extreme weather and high catastrophe, such as COVID-19, when insurers were hit particularly hard.

Taking the longer-term view, a steadier story emerges. Over the past 10 years, for example, the change in share price of the four major insurers has matched the broader market.

With this perspective, we see insurance is about risk pooling, rather than wealth accumulation – ensuring the sector can absorb those risks and restore communities when times are bad – and society depends on it.

After years of muted returns, and sustained losses in the Householders class, the positive performance over the past two years allows the industry a unique opportunity to reflect on how better to serve customers and, importantly, invest in better customer experience. What do your customers need? How can you tailor your offerings and improve efficiency of claims payouts? What’s the role of technology and AI advancements? Addressing these questions proactively will ultimately help to manage risk and claims, as well as reduce costs for customers and insurers.

In the meantime, let’s look at the latest results in more detail and what they say about the industry. Here are the five things you need to know …

This follows strong performance of the two years prior ($3.3 billion over the nine months to 30 June 20242 and $4.2 billion in 2023).

The latest result was driven by:

- Catastrophic losses coming in below expectations

- Strong investment returns – $5.5 billion (7% p.a.) in the 12 months to 30 June 2025, $2.1 billion higher than the nine months to 30 June 2024 (6% p.a. annualised return)

- Several years of double-digit premium increases, particularly in householders, motor and commercial property, impacting the top line

- Reserve releases across both long-tail and short-tail classes.

Return on capital was 19% to 30 June 2025, up from 14% (annualised)3 in 2024.

Householders recorded an insurance service result of $1.16 billion in 2025, the strongest result in more than 10 years.

- Householders recorded an insurance service result of $1.16 billion in 2025, the strongest result in more than 10 years. Affordability and availability is an ongoing issue, with APRA data showing a continued decline in risks written over 2025, and evidence that consumers who retain insurance are increasing excesses to offset cost-of-living pressures.

- Domestic motor also posted a record insurance service result of $1.26 billion in 2025. This exceeded the profit during the COVID-19 period when traffic volumes decreased. Looking forward, growth in electric vehicles (EVs) and increasingly sophisticated technology are leading to more complex and costly repairs. Insurers will need to evolve with the environment to ensure motor insurance continues to meet consumer demand and provides value for money, particularly relating to EVs. This could include partnering with repairers, technology providers and manufacturers to streamline the repair process and improve the availability of required parts, or investing in the training of technicians to alleviate labour shortage issues.

- The market is starting to soften, with average premium reductions and increased competition in commercial property, commercial motor, public liability, professional indemnity, directors and officers, and cyber. Balancing growth and profitability objectives in the near term will be challenging. A focus on relationships now will be essential, helping to build trust over the long term. Proactive steps include implementing risk management initiatives, customer service excellence, a seamless purchasing journey, and ensuring policyholders are not left with inadequate cover, especially for their biggest risks. These will all contribute to fostering policyholder loyalty and confidence in their insurer to do the right thing when it counts the most.

The latest result is $0.1 billion lower than over the nine months to 30 June 2024. Yet it’s still a strong showing for reinsurers, with 2025 producing the second highest profit in the past 10 years

The sturdy result was driven by:

- Catastrophic losses coming in below expectations

- Solid investment returns – $0.5 billion (5% p.a.) in 2025 relative to $0.3 billion over the nine months to June 2024 (4% p.a. annualised)

- Reinsurers being more selective in the risks they write in recent years.

With the reinsurance market softening and the top line coming under pressure, the risk selection and pricing discipline shown over the past few years will come under challenge.

Return on capital was 12% over year, down from 19% (annualised) in 2024.

Measured with reference to APRA’s prudential capital amount, for direct insurers, the solvency capital coverage ratio increased from 177% at 30 June 2024 to 189% at 30 June 2025. For reinsurers, the coverage ratio decreased from 201% to 188%.

Increased focus on pricing transparency

Recent double-digit premium increases in home and motor have led to an increase in complaints and underpin calls for improved pricing transparency. ASIC will examine how insurers communicate changes in premiums to their customers, as set out in its latest corporate plan. A particular issue raised is displaying the actual change in premium over a year by including any discounts in last year’s premium.

As mentioned earlier, the industry’s strong 2025 profit may increase focus on pricing practices and fairness. However, there are actions insurers can take now to improve fairness and transparency. For example, in home insurance, giving policyholders premium reductions for actions they take to improve a property’s resilience and lower claims cost. Suncorp recently launched Haven to help homeowners understand the actions they can take to improve a home’s resilience. It’s an initiative that will benefit insurers, policyholders and the broader community, and we expect other insurers to follow suit if they haven’t already.

Climate change and the energy transition continue to reshape risk and influence profitability

With access, affordability and transparency in the spotlight, climate issues are adding extra pressure. There’s growing concern that rising premiums in response to worsening extreme weather, combined with cost-of-living pressures, could lead to record levels of non-insurance and under-insurance in parts of Australia. APRA’s Insurance Climate Vulnerability Analysis, to be released later in 2025, will provide another lens on potential future general insurance affordability challenges that could be caused by climate change.

APRA’s Insurance Climate Vulnerability Analysis will provide another lens on potential future general insurance affordability challenges.

Monitoring other ways climate change and the energy transition are reshaping risk is also vital:

- Climate change is likely to drive uncertainty in claims costs in more ways than one – Cyclone Alfred led to insurance claims totalling $1.4 billion, as well as a $2.2 billion decline in economic activity. Its unusual path, nearly hitting Brisbane, is a reminder that natural-hazard patterns are changing and driving uncertainty in claims costs. The National Climate Risk Assessment confirms Australians will continue to experience climate hazards – like floods, cyclones, heatwaves and bushfires – more frequently and more severely. And these events are likely to have widespread, cascading and compounding impacts that will reshape risk and influence insurer profitability.

- New technologies and business practices relating to the energy transition will also reshape risk and profitability – 2025 has seen Australian records set in terms of battery storage growth, electric vehicle sales and installed solar power capacity. The ongoing energy transition will create new risks that are unlikely to be manageable based on past experience alone – for example, fire risk from lithium-ion batteries and damage to solar panels from hail or other hazards. These are still relatively new risks to the industry and additional risks will emerge as the energy transition progresses – increasing the importance of underwriting decisions and portfolio risk monitoring across many classes of business.

Continuing AI adoption at pace

AI is leading to quicker and more consistent outcomes for customers. Some examples of AI in action are:

- Claims assistants that summarise product disclosure statements and recommend the next steps for claims managers

- Tools that use images to assess whether a motor vehicle can be repaired or needs to be written off, reducing the time taken to assess claims

- Improving the underwriting process and customer experience by using AI to obtain relevant data, reducing the information collected from individual customers.

While AI applications will continue to expand for some time to come, the focus is now switching to AI governance, data security and cyber risk management. The key here is not only to protect customers with appropriate guardrails but to ensure fair treatment. Nuance is a fundamental feature of the human condition and for those grey areas requiring human qualities, such as empathy and critical thinking, it’s crucial they not be missed, especially for more vulnerable customers. Indeed, these themes have caught APRA’s attention. In its latest corporate plan, the regulator has committed to engaging with larger entities later this year to assess the appropriateness of risk management and oversight practices to support responsible AI adoption. Watch this space.

In an environment of ongoing affordability and cost-of-living pressures during a highly profitable year, the industry has been granted a moment of opportunity. Taking time now to reflect on how to elevate customers’ experience, truly understand their needs and take proactive steps to build more trust will be critical in building a strong foundation for the future. And as technology evolves at pace, these actions will help insurers stay relevant and meaningfully impact the sustainability of insurance in the years ahead. ![]()

- The latest APRA data excludes the September 2023 quarter. Go to about the data for more information. ↩︎

- Results for 2024 are available only for the nine months from 1 October 2023 to 30 June 2024 due to APRA’s transition to AASB 17. ↩︎

- Results for 2024 are available only for the nine months from 1 October 2023 to 30 June 2024 due to APRA’s transition to AASB 17. ↩︎